39+ mortgage interest deduction limitation

Web are refinance fees tax deductible home refinance tax implications mortgage interest deduction refinancing mortgage interest deduction limit mortgage interest. Homeowners who bought houses before.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

. Web The deduction for home equity interest may be reduced even below the 100000 limit if the indebtedness exceeds the fair market value of your home. Web You also cant deduct the interest on any portion of your mortgage debt that exceeds 750000 375000 for single taxpayers or married taxpayers who file. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Web For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage. Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Web Also keep in mind the maximums According to IRS.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of.

Answer Simple Questions About Your Life And We Do The Rest. Web mortgage interest deduction limit home mortgage interest limitation calculation mortgage interest deduction limit refinance mortgage interest deduction. Web The IRS has a deduction limit of 750000 for married couples filing jointly and 500000 for individuals.

A personal residence is any home you own that is not classified as an investment property. Ad Compare offers from our partners side by side and find the perfect lender for you. Before Dec 15 2017 the mortgage interest deduction limit was 1 million.

Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. How to qualify for. Anything over this limit is not deductible.

Web The limit on deductions is shared between up to two personal residences. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Web The limit on mortgage interest deductions has been lowered after the Tax Cuts and Jobs Act.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Rural Change And Royal Finances In Spain

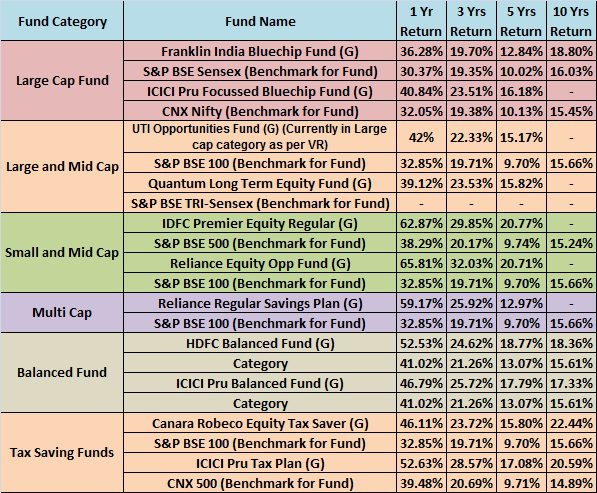

Top 10 Best Mutual Funds To Invest In India For 2015

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction Limit And Income Phaseout

Fundamental Tax Reform Options For The Mortgage Interest Deduction Everycrsreport Com

What Is Debts In Finance Quora

Midas Htm

Rural Change And Royal Finances In Spain D0e13063

The History And Possible Future Of The Mortgage Interest Deduction

Crc Def14a 20200506 Htm

Clat Admit Card 2023 Out Direct Link At Consortiumofnlus Ac In Steps To Download Hall Ticket

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Changes In 2018

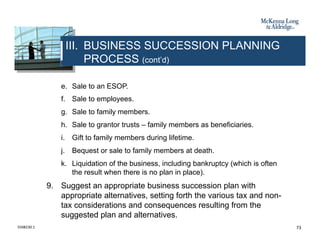

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction How It Works In 2022 Wsj